aSHlaND GREENE INVESTMENTS

Focused Investment Strategy

- We’re focused.

- We know apartments.

- We know our markets.

- It’s why Ashland Greene is efficient and successful.

We specialize in acquiring value-add apartment communities and developing ground-up multifamily development in primary Texas markets.

Ashland Greene leverages industry relationships and implements in-depth analysis to identify unique opportunities.

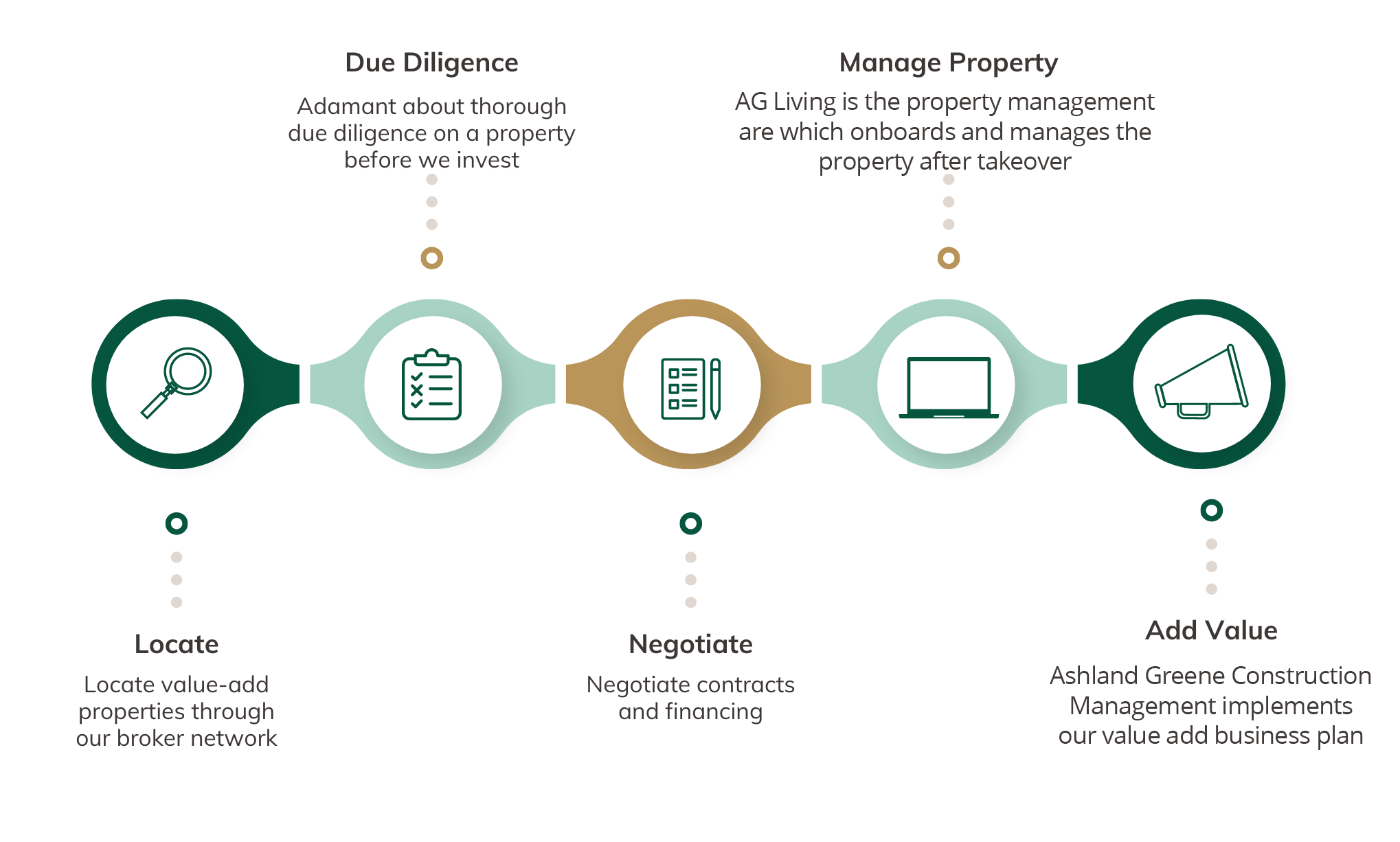

Our Process

FOUR T’S OF INVESTING

1. TRUSTTrust in your sponsor should be your top priority.

VALUE-ADD COMPONENTS

Improve Curb Appeal

Renovate Interior

Enhance Amenities

Enrich the Quality of Life in its Communities

INVESTING WITH ASHLAND GREENE

Choosing the “right” multifamily sponsor and apartment community is critical. Once we’ve successfully completed our thorough due diligence, negotiated contracts and financing, and closed, the next phase of driving success begins.

Integrity

Knowledge

Networking

Consistent cultivation of strong partnerships and a trustworthy network of brokers, contractors, lenders & real estate.

Nimble Negotiation

Attentive Listening & Communication

Technology

Utilizing the latest technologies to ensure effective and efficient processes.

Growing Demand, Emerging Markets

Apartment buildings are historically stable investments.

Over the past four decades, multifamily investments have provided returns that exceed all other real estate property classes.

In the next 25 years, the U.S. population will exceed 60 million further increasing demand for multifamily housing.

All of which make multifamily an attractive investment.

The Compelling Case

Over the past four decades multifamily investments have provided returns that exceed all other real estate property classes. Additional factors that make investing in apartments such a compelling opportunity:

Historically Stable Asset

Housing is an enduring universal need so it performs well in good times and bad.

After the Great Recession (2008), multifamily apartments were among the most popular asset classes and therefore were the fastest to recover and best performing.

Demographic Trends

80 million Millennials prefer to rent vs buy.

70 million Baby Boomers looking to downsize to enjoy a low-maintenance lifestyle.

Rising immigrant population who start in rentals.

Cashflow

80 million Millennials prefer to rent vs buy.

70 million Baby Boomers looking to downsize to enjoy a low-maintenance lifestyle.

Rising immigrant population who start in rentals.

Hedge Against Inflation & Market Fluctuations

Housing is an enduring universal need so it performs well in good times and bad.

After the Great Recession (2008), multifamily apartments were among the most popular asset classes and therefore were the fastest to recover and best performing.

Operationally Efficient

Apartment complexes have economies of scale. The larger the apartment complex, the lower the per unit operating cost.

Tax Efficient & Financing Friendly

The U.S. government allows for depreciation of multifamily real estate faster than other assets, allowing for “paper-losses”, reducing the overall tax burden.

The debt-to-equity ratio of multifamily real estate, is the highest of any asset class, allowing the use of leverage to purchase an asset 4-5 times greater than liquidity.

Diversification & tax benefits

Due to its low correlation to stocks and bonds, the inclusion of real estate in a multi-asset portfolio is often used to reduce volatility and enhance returns.

Additionally, not all investments are equal when it comes to the taxes. Real estate has some major advantages.

Depreciation

Due to its low correlation to stocks and bonds, the inclusion of real estate in a multi-asset portfolio is often used to reduce volatility and enhance returns.

Additionally, not all investments are equal when it comes to the taxes. Real estate has some major advantages.

Refinancing

Taking cash out of the property when you refinance may be done without any refinance proceeds tax free.

1031 Exchanges

1031 tax deferred exchanges allow for the sale of a property that has increased in value and the reinvestment of the gains in a larger property while deferring the taxes indefinitely.

IRA Investing

Investing through your IRA can be done without any penalties via a Self-Directed IRA (SDIRA). When you invest in real estate through your IRA, the income and appreciation it creates grows tax free until retirement.