DISCOVER THE PARK AT ASHFORD APARTMENTs

DFW MULTIFAMILY EQUITY GROWTH OPPORTUNITY

DISCOVER THE PARK AT ASHFORD APARTMENTS Dive Deeper into the Exclusive Deal for Accredited Investors

Enter the Deal Room to explore the Ashland Greene investment opportunity The Park at Ashford Apartments, a prime multifamily equity growth venture exclusively for accredited investors. Discover a hidden gem in the dynamic Dallas-Fort Worth Metroplex, ripe for strategic deep value add enhancements.

Key Highlights:

- Business Plan: Deep Value-Add

- Location: Arlington

- School District: “B+” rating (niche.com)

- Total Units: 144

- Median Household Income: $69,366

- Hold Period: 5 Years

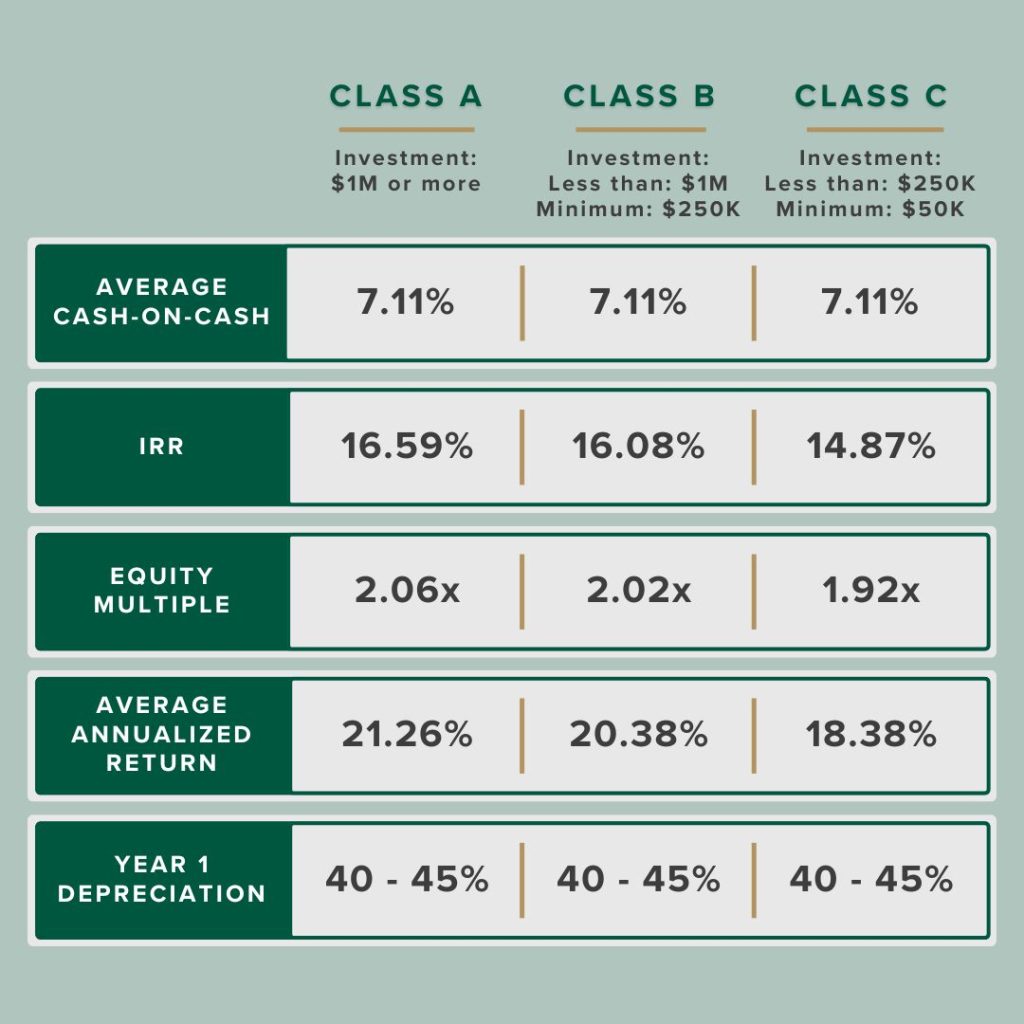

INVESTOR RETURN SUMMARY*

CLASS A, B & C

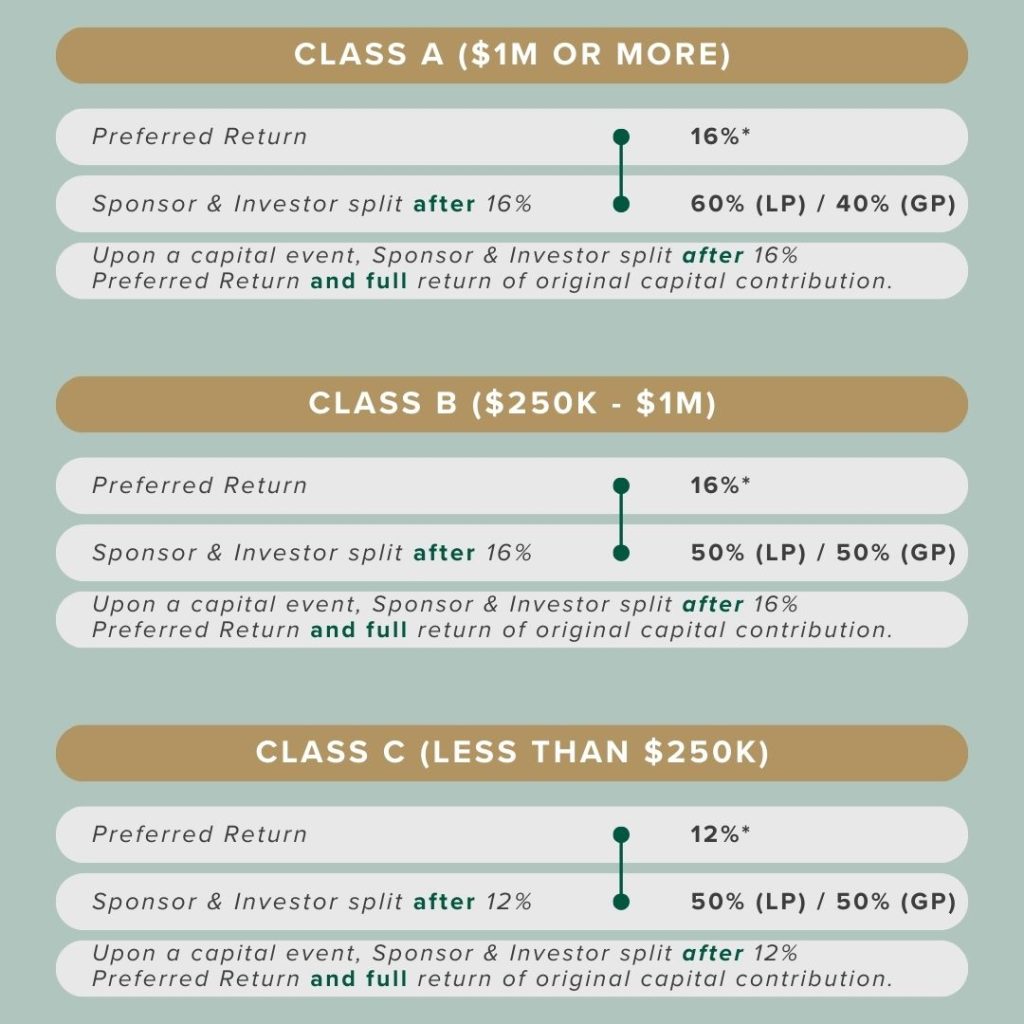

PREFERRED RETURN | PARTNERSHIP STRUCTURE

* A Preferred Return is NOT a guaranteed quarterly coupon, but a simple return that is accrued annually and is offered to the investors before the sponsor participates in any upside. Upon a capital event, Sponsor is not compensated until the preferred return is achieved and the full original capital contribution has been repaid to the investor.

REASONS YOU WILL LIKE THIS DEAL

- UNIQUE PRODUCT – Strong Amenity That Stands Out in the Submarket: Desirable condo-spec townhomes with 9-foot ceilings, attached garages, individually metered utilities, and washer/dryer connections for all units.

- Low Basis – Per Unit Cost Well-Below Comps: Strong basis relative to recent transactions in the submarket.

- Strong Location – Above Average Income: The surrounding area boasts strong demographics with a 1-mile median household income of $69,366, which translates to a 3.78x income qualifying ratio.

Easy Accessibility to Employment Centers Convenient access to Forth Worth, Dallas or Mid-Cities via 1-20 and Highway major employment centers including Arlington ISD, GM Assembly & Financial Services, Texas Health Resources, UT Arlington and Lockheed Martin.

Highly Ranked Schools

Located within Arlington ISD which has a “B+” niche.com rating. - Value-Add ~$11M of Potential for Value Creation – Budgeted ~$3.6M to renovate 135 units to Ashland Greene Platinum as well as add other income drivers, update exterior and property amenities and cure deferred maintenance. Operationally, we will implement AG Living management to drive occupancy and reduce loss to lease. The estimated total value creation is ~$11m.

VERTICALLY INTEGRATED SPONSOR

Experienced In-House Property Management and Construction Teams

AG Living’s proven track record of fixing and repositioning dated assets is built on proactive management of every property, protecting the value of each asset, and ensuring a community culture aligned with our core values.

Ashland Greene Construction Management controls the delivery of the value-add component of the investment strategy. This cohesive group of local tradespeople, using 100% local assets, keeps Ashland Greene Construction Management projects running efficiently, on budget, and on time.

ASHLAND GREENE TRACK RECORD

Founded in 2017, Ashland Greene is a proven, vertically integrated real estate investment firm based in Dallas-Ft. Worth.

FREQUENTLY ASKED QUESTIONS

End of May 2024